Mastering the Fundamentals: Your Guide to Accounting Basics

Published on: January 26, 2025

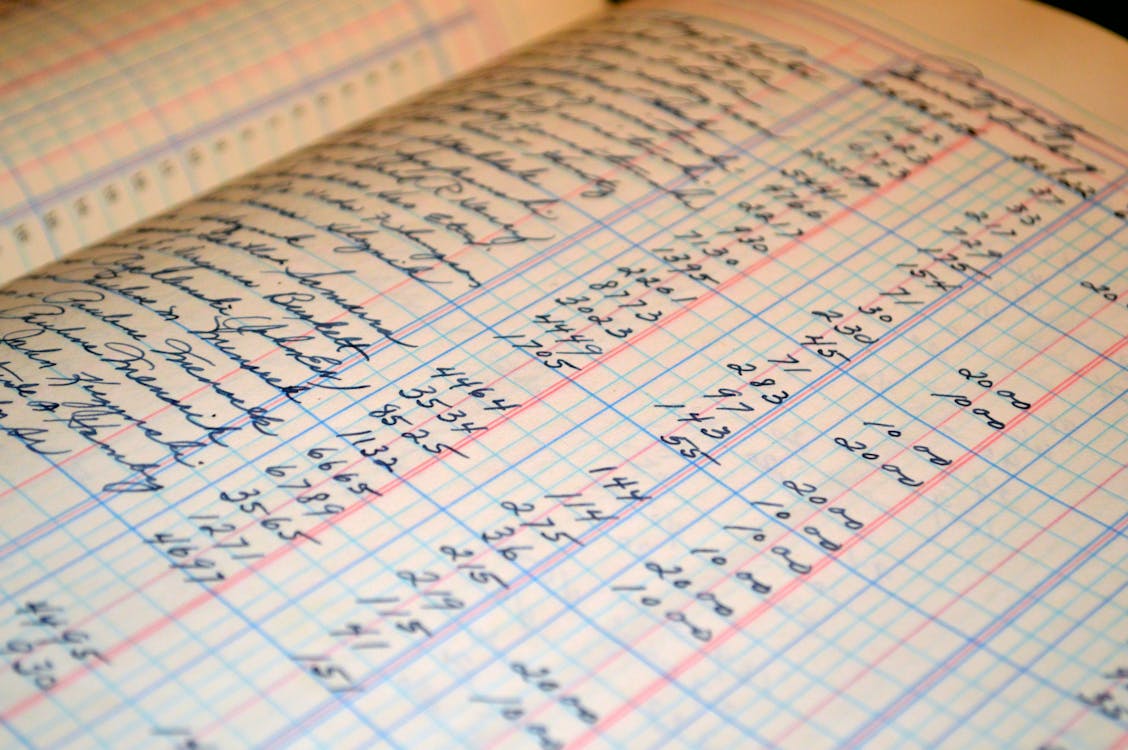

Understanding the language of business is crucial for success! Accounting serves as that language, providing a systematic way to record, summarize, analyze, and interpret financial information. Whether you' re a small business owner, a student, or simply curious, grasping the fundamentals of accounting is a valuable asset.

Why is Accounting Important?

- Tracking Performance: Businesses can monitor their profitability and efficiency over time.

- Making Informed Decisions: Accountants provide data that helps stakeholders make strategic choices about investments, operations, and financing.

- Ensuring Compliance: Following accounting standards and regulations is essential for legal and ethical operations.

- Securing Funding: Lenders and investors rely on financial statements to assess risk and make lending or investment decisions.

Key Accounting Principles You Need to Know

- The Accrual Basis: Revenue is recognized when earned, and expenses are recognized when incurred, regardless of when cash changes hands.

- The Matching Principle: Expenses should be recognized in the same period as the revenues they helped generate.

- The Going Concern Assumption: Businesses are assumed to continue operating in the foreseeable future.

- The Monetary Unit Assumption: Financial transactions are recorded in a stable monetary unit (e.g., USD, EUR, NPR).

“Your reputation is more important than your paycheck, and your integrity is worth more than your career.” — Ryan Freitas.

The Basic Accounting Equation: A Foundation

| Cash | Accounts Payable | Owner's Capital | ||

| Accounts Receivable | Loans Payable | Retained Earnings | ||

| Inventory | Unearned Revenue | |||

| Equipment | ||||

| Total Assets | Total Liabilities | Total Equity |

|---|

Understanding these components is key to interpreting financial statements.

Dive deeper into the accounting equation with this interactive tool

Exploring Key Financial Statements

- Income Statement: Reports a company's financial performance over a period of time (revenues, expenses, and profit/loss).

- Balance Sheet: Provides a snapshot of a company's assets, liabilities, and equity at a specific point in time.

- Statement of Cash Flows: Tracks the movement of cash both into and out of a company over a period of time, categorized by operating, investing, and financing activities.

#AccountingBasics #FinancialLiteracy #BusinessFinance #AccountingPrinciples

About the Author:

Sarah Chen is a Certified Public Accountant (CPA) with over 10 years of experience in helping businesses understand and manage their finances. She is passionate about demystifying accounting concepts for a wider audience. Connect with her on LinkedIn.